nebraska sales tax rate

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The Nebraska state sales and use tax rate is 55 055.

Nebraska Sales Tax Guide For Businesses

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

. 7 Sales and Use Tax Rate Cards. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The Nebraska state sales and use tax rate is 55.

536 rows Nebraska Sales Tax55. The Nebraska sales tax rate is currently. This is the total of state county and city sales tax rates.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Counties and cities in Nebraska are allowed to charge an additional local sales tax on. 65 Sales and Use Tax Rate Cards.

The minimum combined 2022 sales tax rate for Nemaha Nebraska is. With local taxes the. This is the total of state county and city sales tax rates.

The base state sales tax rate in Nebraska is 55. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from. The Wahoo Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Wahoo local sales taxesThe local sales tax consists of a 150 city sales tax.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Columbus Nebraska is 7. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

The Nebraska NE state sales tax rate is currently 55. Average Sales Tax With Local. Find your Nebraska combined state.

The Nebraska sales tax rate is currently 55. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Please ask your organization administrator to assign you a user type that includes Essential Apps or an.

31 rows The state sales tax rate in Nebraska is 5500. Your account is not licensed to use an app that is not public. The Nebraska sales tax rate is currently.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. 6 Sales and Use Tax Rate Cards. The minimum combined 2022 sales tax rate for Norfolk Nebraska is.

Nebraska has a 550 percent state sales tax rate a max local sales tax rate of 250 percent and an average combined state and local sales tax rate of 694 percent. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. 51 rows 55 Sales and Use Tax Rate Cards.

Nebraska Sales Tax Rate Changes January And April 2019

How To File And Pay Sales Tax In Nebraska Taxvalet

All Visits Overnight Pet Care Pricing Nebraska Sales Tax Will Be Added To All Totals

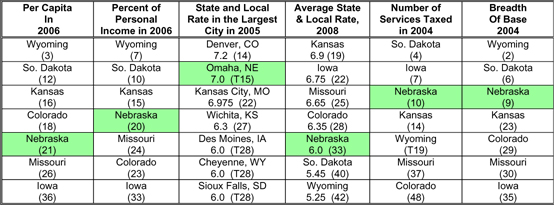

Pro Growth Tax Reform Through Broadening Sales Tax Itr Foundation

Nebraska Sales Tax Rate Changes April 2019

Sales Taxes In The United States Wikipedia

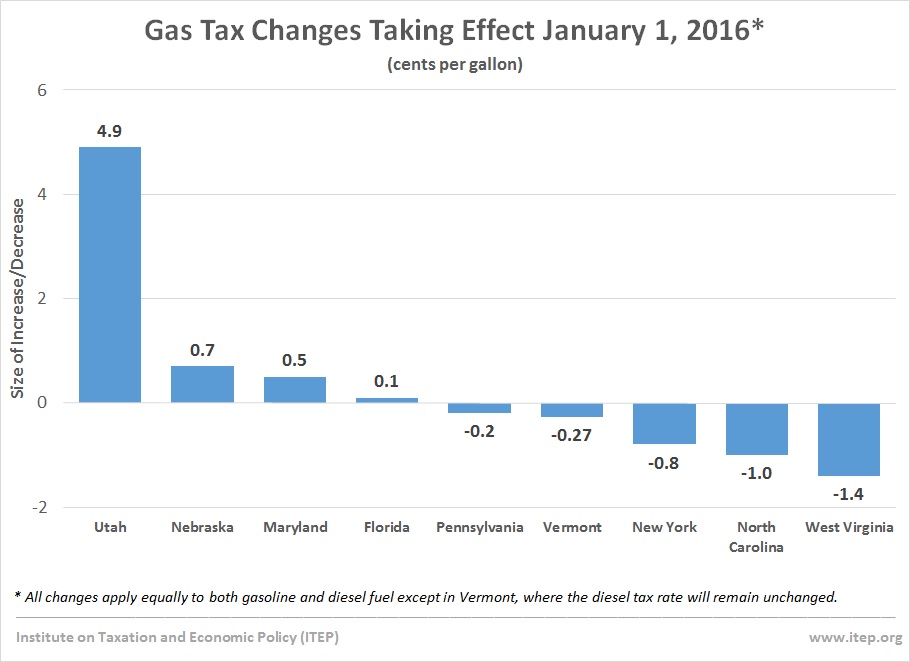

State Gas Tax Changes Up And Down Took Effect January 1 Planetizen News

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nebraska Sales Tax Changes July 2015 Avalara

State Tax Levels In The United States Wikipedia

Sales Tax Laws By State Ultimate Guide For Business Owners

Taxes And Spending In Nebraska

Historical Nebraska Tax Policy Information Ballotpedia

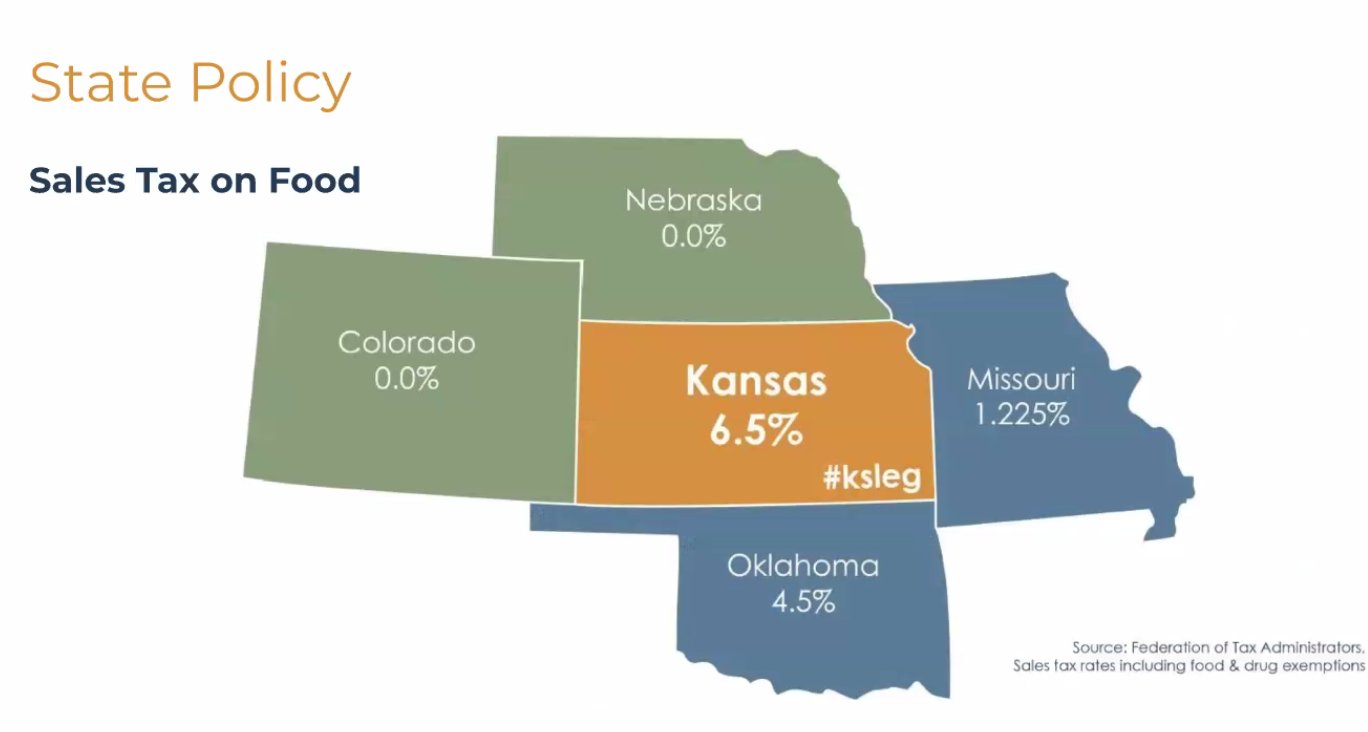

تويتر Centurions على تويتر Kansas Has The Second Highest Sales Tax On Food In The Nation At 6 5 The Same Rate As Most Luxury Items Comparatively Missouri S Food Sales Tax